Content marketing is an indispensable marketing strategy for fintech startups looking to build credibility and gain a competitive edge in today’s market. But the fintech content marketing battlefield is unlike any other. The conventional tactics just don’t cut it here. Marketing strategies for fintech companies are usually an uphill battle to stand out, gain customers’ trust and navigate the regulatory tightropes all at the same time. The path to success requires a deep understanding of the target audience, strategic storytelling, and a relentless pursuit of innovation. Although it is challenging, some financial services companies are getting it right. Case in point: Chime. This content marketing case study will explore how exactly Chime is using content to drive success.

In the upcoming sections, we will delve deep into Chime’s content marketing strategy, exploring all the marketing channels it leveraged to become a fintech success story. Our aim is to provide valuable insights and actionable takeaways for fintech entrepreneurs and marketers who are looking to enhance their own content marketing efforts.

Here is everything that will be covered in this case study on content marketing –

Role of content marketing at Chime

Chime content marketing strategy

- The Chime blog

- Chime in the news

- Chime’s vibrant social media presence

- Chime affiliate program

- Content repurposing for maximizing impact and reach

- Feature-first SEO strategy

What we learned from the Chime content marketing strategy

What is Chime?

Chime is a San Francisco-based neobanking startup that has garnered a reputation as one of the top digital banking platforms in the country. Founded by Ryan King and Chris Britt, this financial technology (fintech) company was created with the aim to provide people with an alternative to traditional banking. It is basically an app, using which users can access a range of financial services like –

- No-fee savings and checking accounts

- Visa debit card

- Fee-free overdraft, and more

While there are many other neobanking solutions in the US market, what sets Chime apart is its unique banking services model. It has done away with monthly service fees, minimum balance requirements, and overdraft fees. This platform also refrains from pushing credit on its users.

Chime’s mission is simple – to make banking easy, accessible, and most importantly, free for everyone. And that’s one of the reasons why this company is now 14.5 million customer-strong.

Role of content marketing at Chime

Chime’s success story has been something of a game-changer for the modern banking industry. In just a few short years, they’ve managed to amass a customer base of primary checking users that rivals US Bank. And in 2022, the fintech company’s worth was estimated at an incredible $25 billion.

This remarkable growth is owed, in part, to their robust fintech marketing strategy. Unlike other challenger banks that rely on word-of-mouth marketing, Chime decided to invest in marketing from the very beginning. In fact, the official launch of the banking app can be traced back to a 2014 marketing campaign, when it made an appearance on the popular American talk show, Dr. Phil Show.

The digital medium has also been a powerful marketing channel for Chime. Over the years, the platform has employed a variety of fintech digital marketing strategies to organically reel in new audiences. From content SEO, social media marketing, and video marketing to unique promotional campaigns, Chime has been continuously experimenting with the newest content marketing techniques to ramp up its audience engagement efforts.

In the past year, their content marketing strategy has undergone a massive overhaul, with Vineet Mehra joining as the new CMO. There is a distinct shift in focus, with most of the content targeted towards capturing the attention of Millennial and GenZ audiences. This will be amply evident as we explore Chime’s compelling content marketing strategy in greater detail in the next section.

Chime content marketing strategy

As we mentioned earlier, Chime leverages a few different fintech content creation and marketing strategies to drive customer acquisition and retention. Let’s take a closer look at these strategies and explore how they contribute to Chime’s content marketing success.

1. The Chime blog

Chime’s blog content is divided into several distinct categories on the blog page, which makes it easier for users to quickly locate any information they need. They can switch between different blog categories with an easy-access tab on the top that lists all seven blog categories. The page also displays featured posts right on top, so that visitors are greeted with the most valuable content as soon as they land on the page.

This neat categorization of blog posts is something we noticed with the Park+ content marketing strategy, and also in the Airtable content marketing case study. It just goes to show that how you present your content is just as important as the content itself.

If we take a look at Chime’s blog content, it clearly shows that the brand puts the customer at the forefront of everything it does. In a recent interview, Chime CEO, Chris Britt, revealed that they take the time to understand the preferences and pain points of their target audience before any product/service-related decision. This ensures that their fintech marketing plan is better aligned with the needs of the audience.

This customer-centric approach is clearly evident in their blog posts, which cover a wide range of topics targeting common customer concerns. For instance, you will find a lot of educational articles covering basic personal finance concepts. This helps increase the brand’s reach to the Millennial and GenZ demographic, who might be looking to learn how to move and manage money better.

2. Chime in the news

This is a section on their website dedicated to all the external publication links that Chime has featured in, which includes prominent names like WSJ, Forbes, Bloomberg, TechCrunch, and others. There’s also a running ticker of these publication logos right on top.

It is a great way to showcase brand authority and gain the trust of consumers. Users who might be on the fence about joining Chime would be able to see the recognition the platform has received from reputable sources. This can be the tipping point that convinces them to take the leap and trust Chime as a reliable and trustworthy financial partner.

There’s another section on the same page called ‘Chime News’, which consists of company announcements and news pieces related to their latest promotional campaigns.

3. Chime’s vibrant social media presence

This is where Chime’s fintech content strategy really shines. Chime puts a lot of effort into developing its social media content, and it is clearly evident from the large following they have on all social media platforms.

Chime’s social media game plan on Instagram and Twitter is a lot like Monday’s content marketing strategy, with a focus on building content that people can relate to. Besides the usual promotional announcements, you will find a lot of memes, funny quips, and short clips/reels leveraging the latest trends. Their Instagram account is especially vibrant, with a focus on eye-catching graphics and a consistent brand-specific color theme.

This type of relatable content is useful for engaging your audiences in a conversation. Memes are especially great for tapping into shared experiences, humor, or cultural references that resonate with a broader audience, including the GenZ and Millenial population. They also gain traction fairly quickly and can go viral, increasing your brand’s visibility and reach to new audiences.

Chime’s social media content on LinkedIn is a little different. The focus is on brand-related news, campaign announcements, and some educational content. This is also a space where users get to know about the people behind Chime through #LifeatChime posts.

Their YouTube content strategy is also quite interesting. Besides educational content, brand collaborations, and promotional ads, Chime has also started some interesting video series like ‘Talk Money to Me’ and ‘Ball on a Budget’.

Building a YouTube video series can be a great way to build a loyal and engaged audience that is more likely to consume your content, share it with others, and become brand advocates. It might also help you reach out to potential customers who may not be actively searching for financial services but can be engaged through compelling content and targeted advertising.

4. Chime affiliate program

Affiliate marketing is another crucial component of Chime’s fintech marketing strategy. The platform runs its own affiliate program in finance and credit card niches, giving affiliates an opportunity to make up to $10 every time someone they refer signs up for Chime. It is available to both individuals and businesses.

Starting an affiliate marketing program can be a great way to market your services to niche audiences. It gives you a chance to tap into the networks and audiences of affiliate partners, extending your reach to potential customers you may not have reached otherwise. And since affiliate programs are performance-based models, you would only be paying for the actual results. It’s essentially a low-risk way to increase your marketing ROI.

5. Content repurposing for maximizing impact and reach

Chime also leverages its existing content to drive further engagement. The Chime member testimonials, which were published as 30-second promotional ad campaigns on YouTube, were repurposed into long-form blog posts on their website. In the same way, the Chime guides available on the blog were repurposed into short-from video guides.

This enables the brand to cater to diverse audience preferences – offering bite-sized content for those seeking quick insights and in-depth resources for those desiring a deeper understanding.

Content repurposing is an effective content marketing strategy to get more mileage out of your content with minimal effort. It also extends the lifespan of your content, enhances its visibility on the SERPs, and fuels engagement on social too.

To really show your audience that you’re a reliable and credible source of information, try presenting content in different formats. This way, you can explore topics more in-depth, provide multiple perspectives, and give your readers comprehensive resources.

6. Feature-first SEO strategy

Chime takes a different approach to search engine optimization (SEO), wherein it focuses on optimizing and highlighting its unique features and offerings. This is what is known as feature-first SEO or featurization-led SEO. This SEO strategy involves the optimization of landing pages, feature lists, product descriptions, and other relevant content with feature-specific keywords.

Chime is one of the top results when you Google their feature keywords, like ‘free debit card’, ‘fee-free overdraft’, ‘fee-free ATMs’, etc. And whenever users run a query with these keywords on Google, they are taken to the feature page on the site, and not the Chime home page.

This approach to SEO is quite different from Marketo’s content marketing strategy, in which the SaaS company relied purely on classic SEO tactics to find potential users. If you’ve been wondering how to use SEO for fintech, this feature-first strategy is worth a try. While traditional SEO tactics are definitely useful for fintech companies too, feature-first SEO lets you attract targeted organic traffic from search engines.

7. Out-of-the-box marketing campaigns

Chime’s unique marketing campaigns are really quite popular. And chances are, you might have already come across some of them, on OTT platforms, television, or online.

In November last year, the company launched a promotional campaign called ‘Happy Chime’, which was meant to double down on its mission statement – providing financial peace of mind to all its users.

Barrett, the ad agency that helped them develop the ‘Happy Chimes’ ad campaign, was also behind the ‘Chime Feels’ ad campaign that came out in February 2023. This ad demonstrated how Chime is helping its users achieve their dreams.

Paid ad campaigns are an incredibly useful fintech content marketing strategy that can help you reach out to a wider pool of audiences. It also gets people talking about your brand.

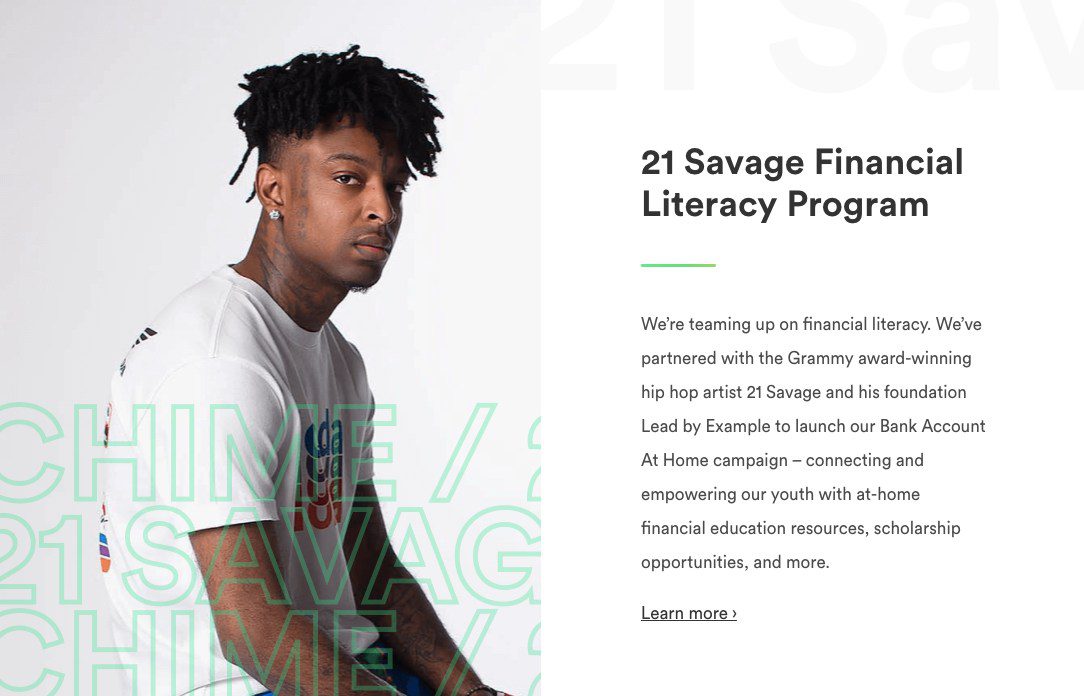

Besides these ad campaigns, Chime runs a few community-based marketing campaigns, with a focus on promoting financial literacy. The 21 Savage financial literacy program is an example of its community-focused initiatives.

What we learned from the Chime content marketing strategy

Chime’s unique content marketing approach has been a key factor in its success, and this fintech content strategy case study is proof of that. The lessons learned here can serve as a roadmap for fintech companies looking to boost their content marketing efforts.

Here are some key takeaways from Chime’s content marketing strategy –

- Blog layout design and content categorization should be done with a singular goal – to make it easier for users to quickly locate the information they need.

- Guide your content marketing efforts with an audience-centric approach. This is crucial if you want to stay competitive in the Fintech content marketing landscape, as customer preferences are constantly changing. Building an audience persona can help you align your content with the needs, preferences, and pain points of your target audience.

- Positive media coverage can shape your brand’s reputation in the fintech industry. If your brand is featured in reputed publications, make sure to highlight that in your content.

- Approach social media marketing with an aim to connect with different audience demographics. Choose appropriate content, tone, and style for each marketing channel, and invest your time and effort into making the content attention-worthy.

- Optimize your content with feature-specific keywords to attract targeted organic traffic and highlight your unique offerings.

- Don’t stick to traditional marketing strategies. Consider starting an affiliate program to extend your fintech brand’s reach through affiliate networks.

- Repurpose content into different formats to cater to diverse audience preferences and extend the content lifespan.

- Unique paid marketing campaigns can help differentiate your brand from competitors in the fintech space, by showcasing your distinct value proposition, innovative solutions, or customer-centric approach.

Create impactful fintech content with Narrato and achieve AI-driven success

As you’ve seen throughout this case study, the role of content marketing is pivotal in the success of fintech brands like Chime. Content marketing can be a great way for fintech companies to reach their key demographic, educate them about their products, and build trust that leads to customer loyalty.

If you’re looking to create impactful fintech content, take advantage of Narrato, the AI content workspace that can help you manage your entire content process from start to finish. Transform your fintech B2B marketing/B2C marketing efforts with unique AI-powered tools like AI writer, SEO content brief generator, AI images, and more.

Discover how Narrato can help you create engaging, persuasive, and results-driven content. Get started today!